Utah Car Sales Tax Out Of State

However non-resident military personnel who purchase a vehicle in Utah must pay the salesuse tax on the vehicle if they plan to operate the vehicle in Utah. Like Florida Michigan exempts out-of-state car buyers from sales tax in the Wolverine State when their home state has no sales tax on cars.

Buy A New Car In Utah Southtowne Automall

What you really want to avoid is paying sales tax in two different states.

Utah car sales tax out of state. Use Taxpayer Access Point at taputahgov and choose Apply Online Apply for tax accounts s TC-69. State Local Option. Sales of goods other than motor vehicles and boats purchased in Utah and removed from Utah by the purchaser or their agent are subject to Utah sales and use taxes.

This website is provided for general guidance only. So if you buy an American-made Ford F-150 Chevy Tahoe or Honda Civic in Michigan but plan on titling and registering it in one of the sales tax-free states Michigan exempts your vehicle from Michigan sales tax. All dealerships may also charge a dealer documentation fee.

Utah collects a 685 state sales tax rate on the purchase of all vehicles. Before you go car buying across state lines make sure you know how to pay the state sales tax properly so you do not end up with a tax. The Af davit for Exclusive Use Outside of Utah form TC-721A does not apply to these transactions.

Interstate commerce does not exempt a sale from sales and use tax. In addition to taxes car purchases in Utah may be subject to other fees like registration title and plate. These requirements became effective for sales occurring on or after January 1 2019.

It does not contain all motor vehicle laws or rules. Sales tax is due even if they choose to register the vehicle in their home state. The process of determining which tax rates apply to individual purchases is referred to as sales tax sourcing and it can be somewhat complicated to figure out.

In Utah Salt Lake County collects a 725 state sales tax rate on the purchase of all vehicles. Each state has its own rules. Often however they will indicate the estimated amount of Nevada sales tax due as taxes paid to Utah.

In addition to taxes. This page lists the various sales use tax rates effective throughout Utah. Delivery must be made by the dealer or by common carrier.

While there are other reasons to consider buying a car out of state you will not save money on sales tax by buying a car in a state with low or no sales tax. In addition to taxes car purchases in Utah may be subject to other fees like registration title and plate fees. Utah dealers do not pay sales tax to Utah on out-of-state vehicle sales.

Some dealerships may also charge a dealer documentation fee of 149 dollars. Utah Resident Service Members Stationed Outside of Utah. Remote sellers can register for a Utah sales tax license using any of the following methods.

You cannot get out of paying sales tax on your new car by buying it in another state. Cities and municipalities in Utah can collect sales taxes up to the. The full amount of Nevada sales tax is due on vehicles purchased in Utah regardless of any statement on the contract.

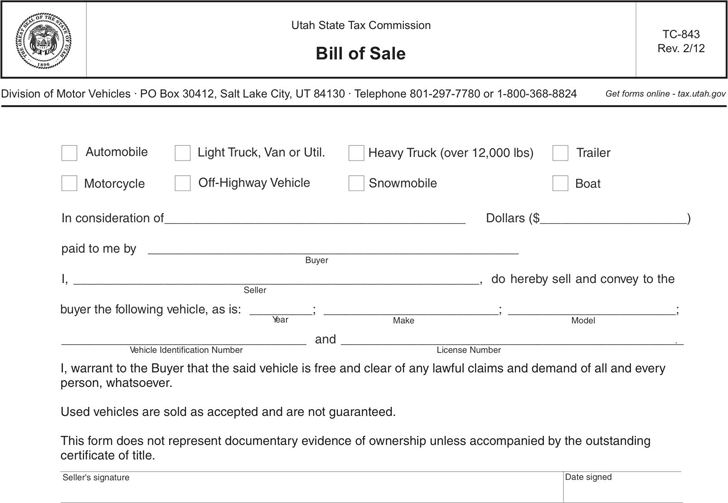

Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here. Utah State Tax Commission 210 N 1950 W Salt Lake City UT 84134 wwwtaxutahgov Sales and Use Tax Exemption Affidavit for Exclusive Use Outside of Utah This sales tax exemption may be allowed only if all names and addresses are complete and this form is signed.

If you purchase any product or service in Utah youre subjected to the states general sales tax rate listed at 485 percent. MakeType Year Model Style Identification number Purchaser Dealer. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes.

Interstate commerce may change the state where sales and use tax are due. Sales to consumers are exempt from Utah sales tax when the vehicle watercraft or merchandise is delivered by a Utah dealer to an out-of-Utah location. If the vehicle is leased make sure the lessor has provided their power of attorney a billing statement and their Utah sales tax number.

Utah residents who are members of the US. If you live just across the border from a state with little or no sales tax it might be tempting to buy your car out of state to save money on sales tax. Mail or fax paper form TC-69 Utah State Business and Tax.

Whether you must charge your customers out-of-state sales taxes comes down to whether youre operating in an origin-based sales tax state or a destination-based sales tax state. If you purchase a car out-of-state and bring it to your home state though it is not always clear which state should receive the tax since tax laws vary by state.

Can You Help Me Understand This Insurance Better Insurance Quotes Health Insurance Quote Car Insurance

Utah Sales Tax On Cars Everything You Need To Know

Utah Bill Of Sale Form Free Fillable Pdf Forms Bill Of Sale Template Bills Utah

Buy A New Car In Utah Southtowne Automall

How To Sell A Car In Utah Privately And Follow All State Stipulations

The Best States To Retire For Taxes Smartasset Com Retirement Income Tax Brackets Inheritance Tax

Free Utah Motor Vehicle Bill Of Sale Form Pdf Word

Free Utah Bill Of Sale Forms Pdf

Free Utah Motor Vehicle Bill Of Sale Form Pdf 102kb 1 Page S

Sales Tax On Cars And Vehicles In Utah

What Does A Tax Refund Offset Letter Look Like Tax Refund Lettering Tax

Utah Raises Its Gasoline Tax Here S What It Means For Drivers

Buy A New Car In Utah Southtowne Automall

/cdn.vox-cdn.com/uploads/chorus_asset/file/22638222/merlin_2873147.jpg)

Is There A Shortage Of Electric Vehicles Pandemic Disrupts Ev Supply Deseret News

When You Meet Someone Treat Them As If They Were In Serious Trouble And You Will Be Right More Than Half The Time Just Wanted To Post A Reminder Tonight I

Post a Comment for "Utah Car Sales Tax Out Of State"